Lockwood Development eyes Anbang's hotel portfolio

by Elliott Mest | Sep 7, 2018 4:00pm

Las Vegas’ Lockwood Development Partners is joining efforts with a number of unspecified hotel franchisees to mount an acquisition of assets from Chinese holding company Anbang Insurance Group Co., Ltd., which is pulling an about face.

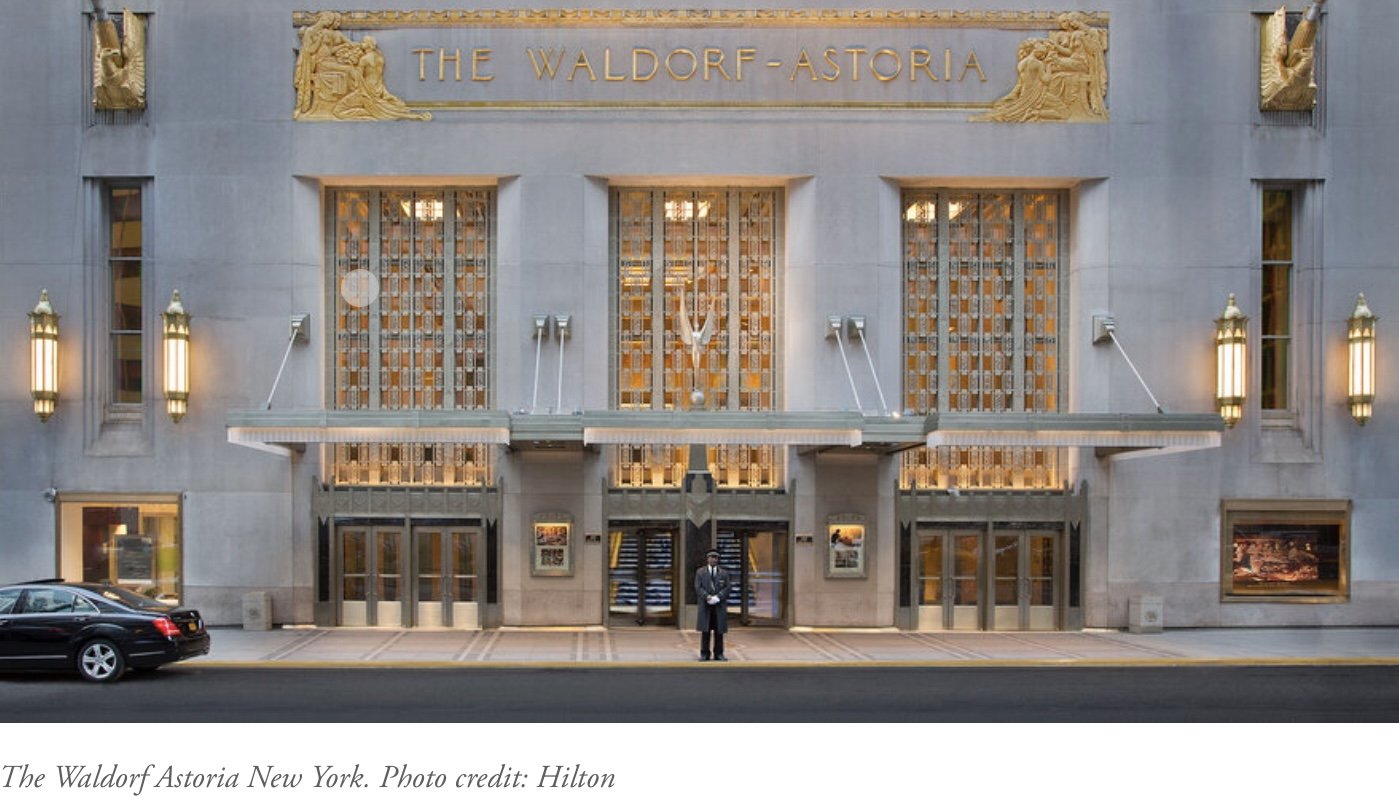

Anbang has spent the past few years amassing a portfolio of 18 luxury hotels in the U.S., including the venerable Waldorf Astoria New York, which it acquired for nearly $2 billion in 2014. But situations have changed, particularly following an investigation into the company’s dealings by China’s Insurance Regulatory Commission that led to the jailing of former Anbang chairman and CEO Wu Xiaohui on charges of embezzlement and fraud. Now, the insurance giant has been tasked with liquidating its assets.

In August, Anbang listed 15 of its 18 hotels for sale, asking $5.5 billion for the entire portfolio. The portfolio does not include the Waldorf Astoria New York, but it does include Manhattan’s JW Marriott Essex House.

Speculation abounds regarding who may ultimately buy the portfolio. Earlier this year Blackstone Group, the previous owner of the Waldorf Astoria New York and a number of other hotels in Anbang's portfolio, was in talks with Anbang to reacquire a number of the company’s assets. The price tag on the portfolio limits interested buyers mostly to large private equity firms like Blackstone and sovereign wealth funds, but one prospective buyer already has made its intentions known to acquire the portfolio.

According to Charles Everhardt, head of acquisitions and development for Lockwood, the company began paying attention to Anbang following the jailing of Xiaohui, and confirmed the targeted portfolio will include five Four Seasons Hotels, two Ritz-Carlton properties, two InterContinental hotels, the Montage Laguna Beach (Calif.) and the Loews Santa Monica (Calif.).

“We were immediately interested in [the portfolio] because it represents some of the most iconic hotels in the U.S.,” Everhardt said. “These are quality properties. You can’t find real estate like this without it being new construction.”

ALL IN

Everhardt said Lockwood intends on being part of the ownership for these hotels, but will not represent the majority of the capital involved in the transaction—that distinction would belong to the undisclosed franchisees involved. However, Lockwood is seeking to gain as large a stake in these properties as it possibly can. One of the main challenges facing the company, Everhardt said, is working with a foreign government to acquire so many assets.

Furthermore, Everhardt expressed interest in acquiring all of Anbang’s hotel assets, including the Waldorf Astoria New York.

“The primary issue is not so much having the capital to buy these hotels, but to have a clear path with the Chinese government to sell them at an agreed-upon price,” Everhardt said. “We aren’t dealing with Anbang in this transaction, but the government. So in trying to get the Chinese government to allow us to bid for everything, there is no clear path on that at this point.”

International tension between the U.S. and China on topics such as trade are not helping the situation. Everhardt mused the recent trade fracas, mixed with the portfolio’s sale at the hands of the Chinese government and not Anbang, is likely why a company like Lockwood is best positioned to navigate the sale.

“If it were a simple procedure, then a lot of other companies would find it easy and get involved,” Everhardt said.

FAST BREAK

Sean Hennessey, clinical assistant professor at the Jonathan M. Tisch Center for Hospitality & Tourism, said the Chinese government’s treatment of the Anbang portfolio shows an anxiousness to part with it. He also said that it is likely China would be willing to sell the Waldorf Astoria New York as well, even at a loss, because this will allow it to avoid funding costly ongoing renovations of the property.

“They paid so much for that hotel it would be hard to imagine [China] getting out of the transaction whole,” Hennessey said. “However, if they see an attractive price they would be able to eliminate future funding requirements for the hotel.”

Michael Bellisario, senior research analyst at financial services company RW Baird, said there is an ongoing pullback from Chinese investment in the U.S. hotel sector, and he expects political pressure at home and attractive pricing for U.S. assets as limiting factors.

“Against every different bucket of capital, foreign buyers are all interested in U.S. real estate. All of them, except for China,” Bellisario said. “Some of that is capital controls and a crackdown on the money being moved there. If it’s Hong Kong, that’s a different story.”

Everhardt hinted he would like to close the transaction before November, but Bellisario said that would be unlikely unless China is shopping the portfolio directly to Lockwood.

“If it’s being marketed for sale to a select group it’s possible, but if I had to guess, a 2019 closing is more likely than 2018,” Bellisario said. “But there isn’t a lot to go off of right now. A lot of us are in the dark.”